We are really excited to announce a powerful new feature for ProjectionHub users – Scenarios

This new feature will allow entrepreneurs to do what if analysis on their projections quickly and easily.

For many entrepreneurs the whole point of creating financial projections is to be able to compare and contrast financial results based on different scenarios and different assumptions. As we release this new feature I wanted to write a short blog post that gives you some ideas of how startups can use “What If Analysis”:

1. What if I Lose My Largest Customer?

This is a question that your banker will likely ask. They want to know whether you can cover your fixed costs and debt service even if you lose your largest customer?

2. What if Google Changes Their Search Algorithm?

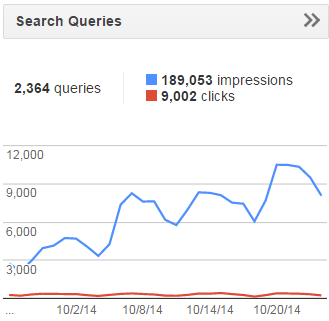

This happens all the time. Google Gives and Google Takes Away. Lately ProjectionHub has seen some nice increases in our search results on Google, but it is altogether possible that we could wake up tomorrow to find that Google has changed its search algorithm and a significant portion of our visitors is gone. Here you can see recent search growth for us at ProjectionHub. It is great! But we need to be thinking about how our business changes if this changes?

3. What if the City Starts Construction on our Road?

For retail businesses a major risk can be construction. If all of a sudden it becomes difficult to get to your place of business, what is going to happen to sales? How much of your sales is based on drive by traffic? Or are your customers loyal enough to drive through construction to get to you? If you already know construction is scheduled to happen on your road, you might want to do What If analysis to project what happens if construction goes longer than expected.

4. What if We Don’t Raise More Capital?

For many high growth startups you have a limited amount of time before you will run out of cash. Your Burn Rate is the amount of negative cash flow per month that your company is experiencing. You should know your burn rate so that you know how many months you have before you will need to raise a new round of capital, and you might want to run some scenarios to see what happens if it takes longer than expected to raise money. What adjustments will you need to make?

5. What if We Hire Another Person?

What happens if you hire a new person? Obviously expenses will increase, but what about sales? Will you be able to produce more, or sell more? How much more?

6. What if We Don’t Hire Another Person?

Another question that you might want to ask yourself is what happens if we don’t hire another person? Maybe you won’t ever be able to reach breakeven with your current sales volume so you almost have to hire a new person. Or maybe hiring another person will actually make your current employees less efficient.

7. What if Fuel Prices Increase?

Finally, what if your input cost increase? What if your business is highly dependent on fuel prices, what would happen if gas goes to $5 a gallon? Is the business still sustainable? Think about other input costs like labor costs or steel costs etc.

We believe that it is incredibly important for entrepreneurs to ask questions, do what if analysis with your financial projections and determine how you need to mitigate certain risks, and what decisions to make to help grow the business or increase sustainability. What other scenarios do you like to run for your business?

Leave a Reply