According to the 2018 Fitness Industry Analysis, there are 145 million members of health clubs around the globe, and the fitness centers that serve these members are estimated to have earned an industry total of $84 billion!

According to the 2018 Fitness Industry Analysis, there are 145 million members of health clubs around the globe, and the fitness centers that serve these members are estimated to have earned an industry total of $84 billion!

Are you ready to jump into this booming industry?

Before you invest your life savings, make sure you understand your gym financial projections and what it will take to benefit from your investment. The following blog post will walk gym owners through the process of creating financial projections using our web app, ProjectionHub.

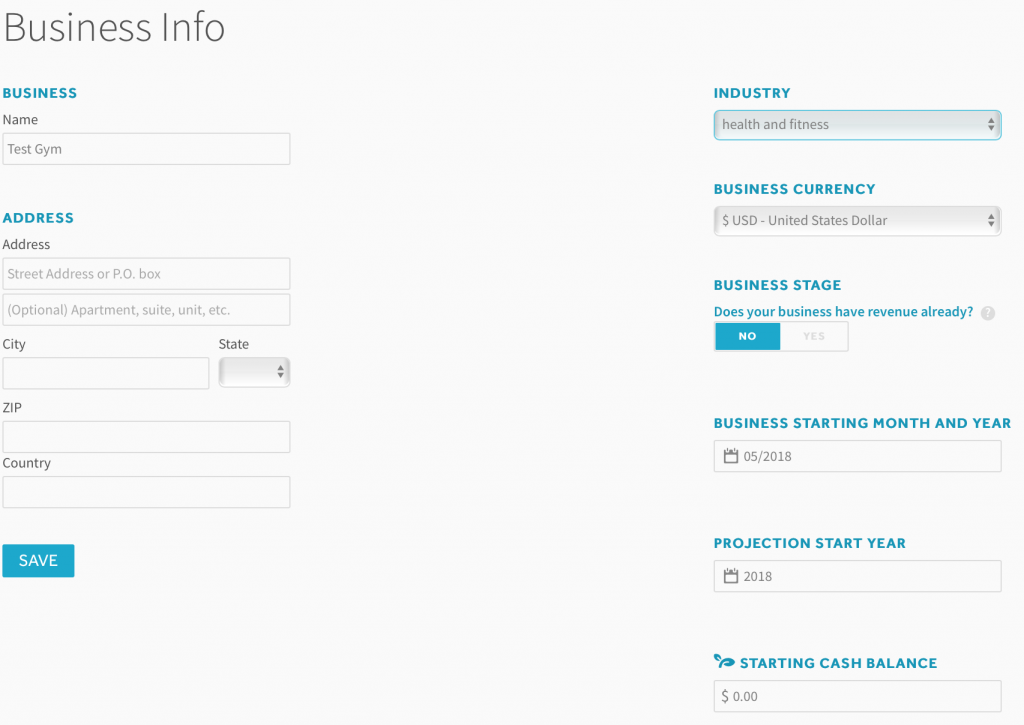

General Business Info

Once you sign up and confirm your account you will be asked to complete some general business info as seen below:

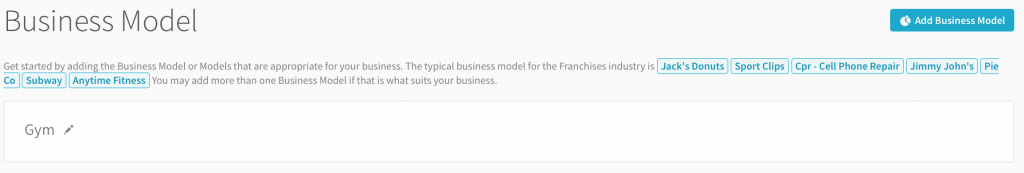

Adding the Gym Business Model

Once you save the general business info, you will be able to add a business model. If you don’t already see a Gym Business Model added on this page, you can click the add Business Model button as seen below to add your first gym:

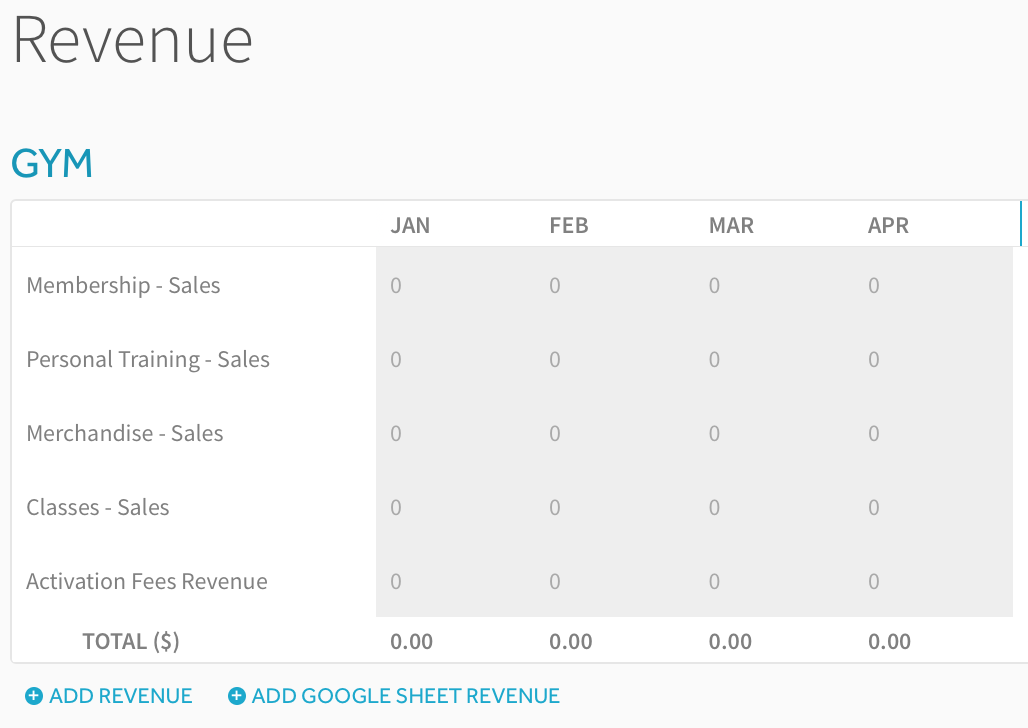

Revenue

Next you can click the orange button to Add Revenue to get started with your sales projections.

Our web application will create certain categories of revenue based on your business model; however, you will now have 2 options as you see in the image below:

- You can click “Add Revenue” which will give you the ability to add projected revenue numbers for each month for your gym.

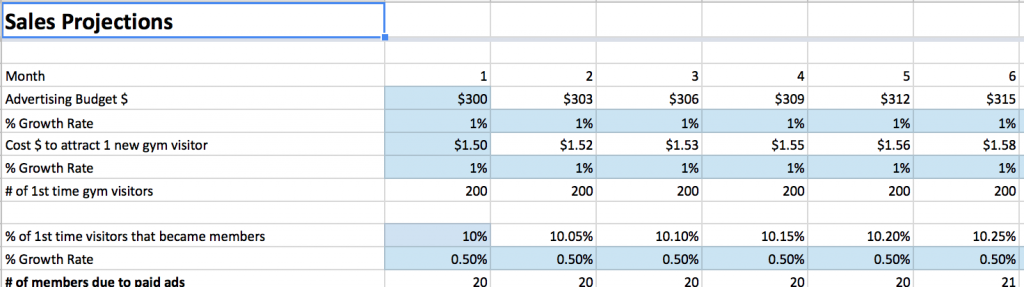

- Or you can click “Add Google Sheet Revenue”. We have created a special Google Spreadsheet template specifically for fitness centers that will give you more control in terms of adding assumptions for your average membership price and number of members each month.

- If you decide to utilize our Google Sheet template please see this guide on how to enable the Google Sheet Integration. You can see a screenshot of the Google Sheet below:

Expenses

Once you complete your revenue projections you can move on to your expenses. There are 2 primary types of expenses:

- Startup Expenses

- Ongoing Operating Expenses

Here is a list of potential startup costs when starting a gym based on information from Anytime Fitness:

- Real Estate/Improvements

- Equipment

- Supplies/Furniture

- Outside/Inside Signage

- Advertising

- etc.

As you know more about your specific costs you can update this list. Some of the items listed as startup expenses should be entered as expenses on month 1 and some are actually cash spent on assets like:

- Leasehold improvements

- Equipment

- Buildings

If you have any of these types of expenses you will want to add them later as an “Asset” instead of an “Expense” on this page.

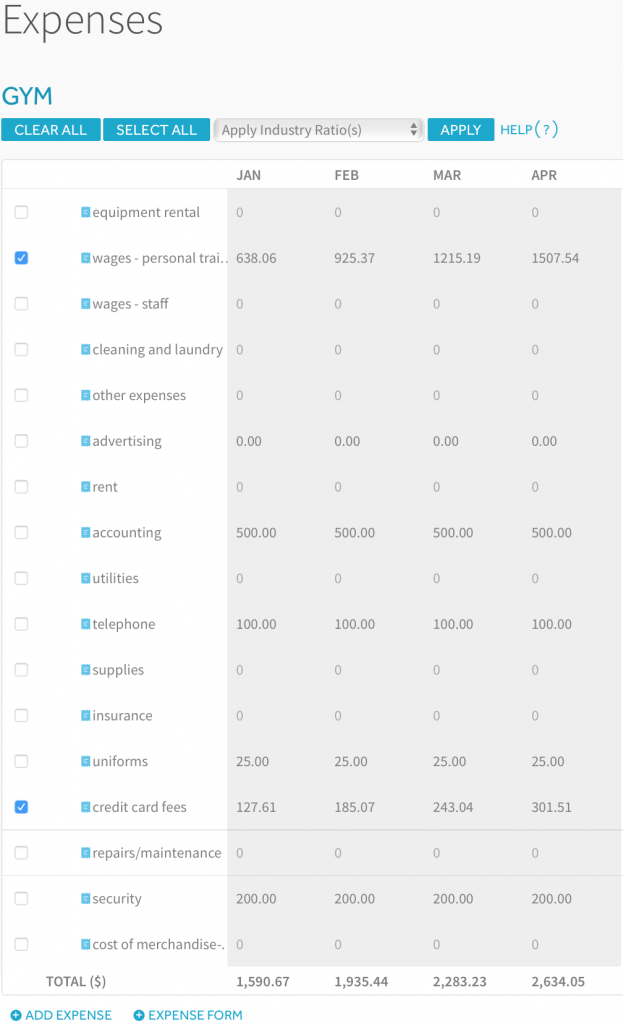

Operating Expenses

On the Expenses page in ProjectionHub you will be able to add/update your operating expenses. You will notice that the Expense page will come with a number of standard expense line items along with a default monthly expense for most of the line items. Obviously you can change any of these default expenses to reflect your specific situation.

Some expenses will be a % of your total sales, instead of a fixed monthly amount.

So as you see in the image above you can click the check boxes next to those expense categories and then in the drop down box you can select “Apply Industry Ratios” and then click “Apply”.

ProjectionHub is using a 15% of sales ratio for the personal training wages and a 3% of sales ratio for the credit card fees. So when you click “Apply Industry Ratios” the system will take your projected sales and multiply them by 15% to come up with your personal training wages for example.

Assets

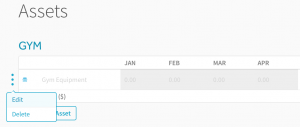

Next you can move on to the assets section. You will notice that the Assets page comes pre-loaded with the default assets that you might have as a Subway franchise owner.

To add an asset, hover over the row, see the 3 dots on the left of the asset name, hover over, and click edit.

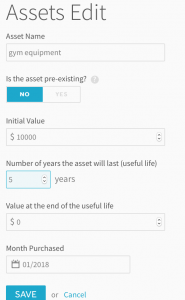

Next you will be able to add your Gym Equipment as an example. You can enter in the details of your assets as seen below:

Loans

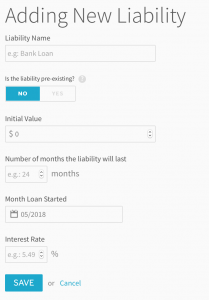

Next you can move to the Liabilities page and add a loan. If you are going to borrow to help fund your startup costs, you can “Add a Liability” as seen below:

Then, you can insert the details of your loan/other liability:

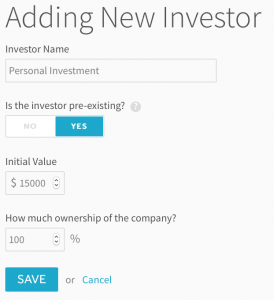

Investors

Next you can add any personal investment you will be making as well as investment from outside investors. One common situation may be that you pay a franchise fee with your personal investment. In the example below we assume that you paid a $15,000 franchise fee as a personal investment, and we selected that the investment was pre-existing which means that the projections will assume that you already paid the $15k prior to the projections starting, so this will show up on your opening balance sheet as equity.

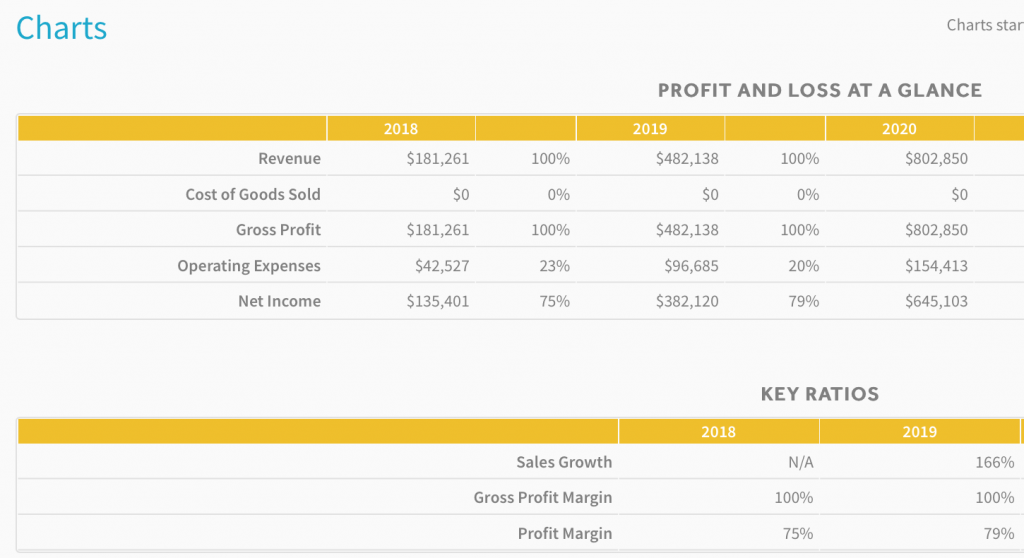

Reports

Once you enter in all of your assumptions you will be able to review a number of reports. Here is a sampling of some of the reports, tables below:

On the Dashboard page you will be able to download your projection Income Statement, Balance Sheet and Cash Flow projections to share with your lender or investor.

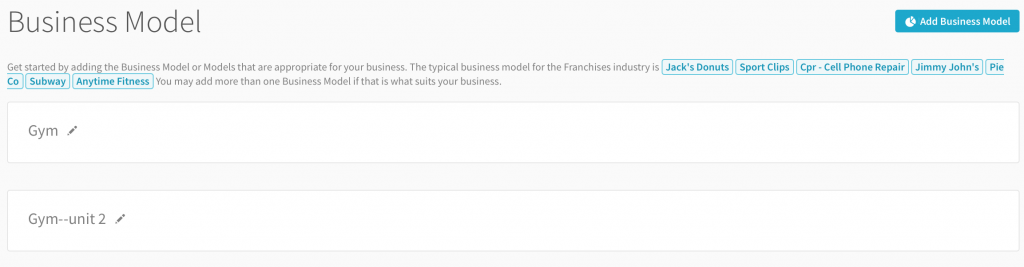

Adding Multiple Gyms

Finally, let’s assume you want to add another gym in the future. All you need to do is go back to the “Business Model” page and add another “Gym” business model. You can then label it Gym–Unit 2 and you can repeat the process. You can add as many units as you would like over time.

Again, you can get started by creating a ProjectionHub free trial account today.

As you complete your projections please don’t hesitate to reach out to us with questions at support@projectionhub.com

Good luck!

Leave a Reply