Thinking about starting a coffee shop? If so, you aren’t alone. There are 20,000 coffee shops in the U.S. according to First Research. The problem is that most startup coffee shops fail. If they don’t fail they tend to struggle along and just reach breakeven.

Thinking about starting a coffee shop? If so, you aren’t alone. There are 20,000 coffee shops in the U.S. according to First Research. The problem is that most startup coffee shops fail. If they don’t fail they tend to struggle along and just reach breakeven.

According to a March 2009 Seattle Times article, the average coffee shop has $150,000 to $500,000 in startup costs. So the common problem is that business owners are undercapitalized and start on day 1 with no cash in the bank. Before you invest a single dollar into starting your coffee shop you should create a set of financial projections.

In this blog post I am going to show you exactly how to create a set of projections for a startup coffee shop.

You might be interested in: Coffee Shop Financial Projection template

How to Project Sales for a Coffee Shop

The first thing you will need to figure out is some assumptions for how to project sales. Here are some sample assumptions that you will need to answer for your own unique situation:

- Starting Number of Customers Per Day = 50

- Number of Days Open Per Month = 26

- % Monthly Growth Rate of Customers During Year 1 = 5%

- % Monthly Growth Rate of Customers During Year 2 = 1%

- % Monthly Growth Rate of Customers During Year 3 = 1%

Instead of trying to project how many lattes, coffees, muffins, bagels etc you will sell, it is much easier and probably just as accurate to just estimate the average purchase per customer visit and then estimate what your average cost would be for that order. Here are a couple of related assumptions:

- Average Purchase per Customer Visit = $5

- Average Cost of Goods Sold per Customer Visit = $2

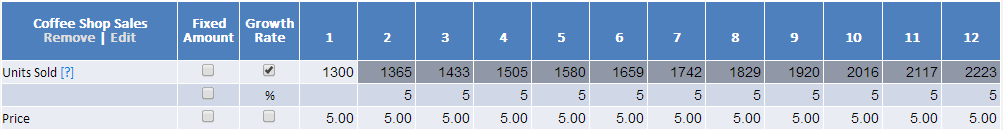

Based on these assumptions I created sales and cost of goods sold projections using ProjectionHub. Here is a screenshot:

Coffee Shop Salaries

Next you will be asked about Salary Expenses. We already built in some wages for baristas through the labor costs section of Cost of Goods Sold. We assumed that on a $5 order there would be $1 of labor involved which goes to pay wages. These employees will also make a living off of tips.

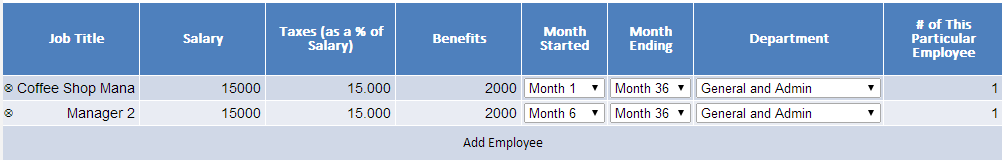

So for the salaries section you might just have 2 salaries for 2 part time managers. Let’s assume you pay each one $15,000 per year since they are only part time. Let’s assume that the first manager starts in month 1, and the second manager starts in month 6 as sales start to pick up. During those first 6 months you as the owner may need to put in more hours. Here is a screenshot of the salaries module:

Next I entered in the monthly expenses that I would expect the shop to have like rent, utilities, supplies, insurance, accounting, and advertising.

Coffee Shop Startup Costs

Next we need to look at startup costs for the coffee shop. Again, as mentioned previously this can cost between $150,000 and $500,000. Here is what I budgeted for startup costs:

- Build out of space = $50,000

- Required starting cash balance = $30,000

- Initial Inventory = $5,000

- Equipment = $30,000

- Furniture = $10,000

So this is a low end estimate at $125,000 in startup costs. Now I have to enter where I intend to get that $125,000 in funding. I split it up between a $75,000 bank loan and a $50,000 owner investment.

That just about wraps up your projections for a coffee shop. In the example I just created the shop just breaks even in year 1 and is profitable in year 3 with a net income of $27,000 on revenue of $160,000.