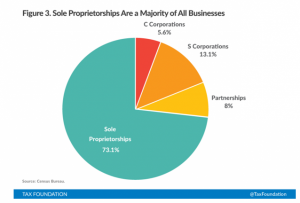

According to TaxFoundation.org, 94% of businesses are what are called “pass-through businesses” which means that the business does not pay income taxes itself, it passes through the tax liability to the owners. So for 94% of the 28 million-ish businesses in the US that are pass-through entities, the owners need to be able to accurately estimate how much they will owe in income taxes due to the profit or loss of the business.

According to TaxFoundation.org, 94% of businesses are what are called “pass-through businesses” which means that the business does not pay income taxes itself, it passes through the tax liability to the owners. So for 94% of the 28 million-ish businesses in the US that are pass-through entities, the owners need to be able to accurately estimate how much they will owe in income taxes due to the profit or loss of the business.

We work with a lot of small business owners who act like tax time is this big surprise, they wonder:

- Will I get a refund this year?

- How much am I doing to owe?

The exact dollar amount you will owe in federal income taxes will be nearly impossible to predict perfectly because it is based on 100s of different personal factors like family size, your investments, whether you own or rent a home, your charitable giving, etc, etc. So the purpose of this post is to help you understand how it works so that you can get much better at estimating how much you will owe in taxes so that it is not a surprise.

There are 4 simple steps to know how much you will own in taxes due to your business income.

Step 1 – Calculate the Net Income of the Business for the Year

Hopefully you have been keeping track of all of your income and expenses for the year with software like Quickbooks, or through your accountant. If so, you are in good shape, you will need to access your Profit and Loss (aka Income Statement) report. At the bottom of the report it gives you your “bottom line” which is your net income for the year.

Step 2 – Determine What Percentage of the Net Income of the Business is “yours”

Next, you only have to pay taxes based on the percentage of ownership that you have in the company. So if you own 100% of the company you will be responsible for all income taxes; however, if you only own 10% you simply need to take the Total Net Income of the business and multiply by your Percentage of Ownership to determine how much of the net income you are responsible for.

Step 3 – Use the Federal Income Tax Brackets to Calculate What you Owe for the Business Income

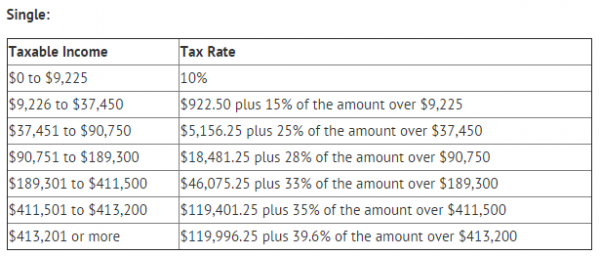

Each year the federal government publishes the personal tax brackets which gives you everything you need to know to calculate how much tax is owed per dollar of income. You can find the tax brackets published here for 2015. As you can see in the table below, you don’t pay the same percentage of tax on each dollar of income.

Step 4 – Remember This all Flows Through to Your Personal Tax Return

So let me do my best to explain how this works. The table above shows the percentage of tax that you will owe for each various dollar amount in income. Now remember this is a pass through entity so this is a personal income tax bracket. When you business makes net income that net income is passed through to the owners. You may also have other income that plays a role in how much you owe in taxes. For example, let’s say you also have some dividend and interest income from your investments, and maybe you have some rental income from a residential rental home that you own. All of this income will be added to your business income, but right now I want to keep things simple and assume that your only income is your business income.

If this is truly your only income then you can simply follow this table and figure out exactly how much you will owe in federal income taxes.

You can find many useful templates to assist you with this on our website

Predict What You Will Owe in Taxes Next Year

Finally, you should now spend some time forecasting what you will owe in taxes next year so that you know how much money to set aside each month for taxes.