Whether they offer an entire home or apartment, a spare bedroom, a cabin or an RV parked in the backyard, hosts in 191 countries (as of June 2019) have joined the Airbnb marketplace. The Airbnb proposition is attractive to hosts and travelers alike: hosts make money on otherwise unused space, and travelers pay less than they might at a traditional hotel while enjoying a more unique experience. Today, many Airbnb hosts have moved beyond earning passive income on an empty vacation home and have launched viable businesses with multiple properties offering hotel-like amenities.

If you’re looking to open your own Airbnb, you’ve probably already explored Airbnb’s website. Maybe you’ve been an Airbnb guest and thought “hey, I could do this.” Maybe you have a property ready to be rented out, or maybe you’re considering the purchase of a new property specifically for earning income.

Regardless of your situation, before you start looking at real estate listings or picking out new towels, you want to know how much money you can expect to make as an Airbnb host. The best way to predict profit is to put together financial projections, which can help you answer the question: “Can I make money running an Airbnb?”

Financial Projections for an Airbnb

At ProjectionHub, we have developed a web application integrating a Google Sheet revenue model specifically for Airbnb hosts. Our model incorporates the financial factors of Airbnb operation, including:

- Number of rooms available

- Room price per night

- Seasonal pricing changes

- Seasonal volume changes (do you expect more guests at your lake house in the summer? Or maybe you’d expect the winter months to be more popular at your cabin by a ski resort.)

- Multiple types of rooms

- Additional revenue from extra guest fees and cleaning fees

- Additional revenue from providing Airbnb experiences or extra services such as bike rentals or breakfast

- Expenses specific to Airbnb

- Our model can even help you design an Airbnb empire – you can add as many properties as you’d like to your new business plan

This blog post will walk you through how to use the ProjectionHub.com web application to generate your financial projections, whether that be for your own internal planning, or so that you can hand ready-made projections to potential lenders and investors.

Signup Instructions

- Feel free to learn more about ProjectionHub in general before signing up.

- You can sign up for a free trial by selecting the “Airbnb” template here.

- If you have any questions about the model as you go, please email support@projectionhub.com

Tell us about your Airbnb

Once you sign up and confirm your account you will be asked to complete some general business info. On this page you can tell the app if your business has already started earning revenue, or if you’re just in the planning stages. Be sure to enter the starting cash balance you will expect to have when you start running, as it will be included in the cash flows report the system will generate for you.

Once you save the general business info, you will be able to add a business model. If you don’t already see an Airbnb template added on this page, you can click the “Add Business Model” dropdown menu as seen below to add your first Airbnb property.

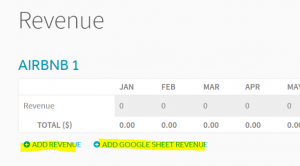

Airbnb Revenue Projections

Next you can click the orange button to Add Revenue to get started with your revenue projections.

You will have two options as highlighted in the image below:

- You can click “Add Revenue” which will give you the ability to manually add projected revenue numbers for each month for your first property.

- Or you can click “Add Google Sheet Revenue”. We have created a special Google Sheets spreadsheet template specifically for Airbnb that will walk you through all the different considerations in predicting Airbnb Revenue. To customize your revenue predictions with Google Sheets:

- Click on the “Add Google Sheet Revenue”

- Follow the instructions and sign into your Google account (if you don’t have one already, you can create a Google Account for free here).

- You may need to navigate back to the ProjectionHub tab and click “Add Google Sheet Revenue” again after signing into Google. The sheet may take a minute to open.

- Once the spreadsheet opens, you can modify the assumptions as you see fit.

- When you’re happy with your revenue model, navigate back to ProjectionHub, click on the three dots next to your last revenue item, and select “Import Google Sheet Revenue”

- If you’re struggling to get to the Google Sheets page, check out this guide on how to enable the Google Sheet Integration.

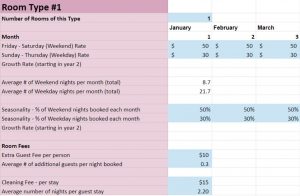

You can see a screenshot of part of the Airbnb Google Sheet revenue model below:

For your Airbnb revenue model, you will want to consider the following factors:

- Number of rooms / rentable spaces you will offer

- Price per night for each room type, which may vary by month and weekend vs. weekday

- Percentage of nights filled per month for weekends and weekdays

- Additional revenue from fees such as extra guest fees and cleaning fees

- Additional fees for extra services like bike rental or local tours

These items are already set up in the Google Sheet Airbnb revenue model within ProjectionHub. You can modify any of the assumptions in blue to get your projected revenue model, and then import to your projections in ProjectionHub.

Expenses

Once you complete your revenue projections you can move on to your expenses. An Airbnb host should consider the following expenses:

- Airbnb’s set 3% fee which is gathered on all transactions

- Rent if the property is not owned

- Additional taxes and permits based on locality

- Cleaning expenses, whether cleaning supplies or a service

- Additional insurance expenses. Some insurance policies will increase premiums if a home is used mostly as a rental

- Additional damage or liability insurance if desired

- Complimentary guest items such as toiletries, and snacks

- Cost of any food offered as an additional service

- Cost of internet service provided to guests

- Increase in utilities bills from guest use

- Note that many items purchased to get an Airbnb up and running are actually assets. See our section on assets below to learn how to incorporate these items into your financial projections.

The expenses listed above, and some additional items to consider, are pre-filled for you on the Expenses page within ProjectionHub. You can customize whether the expenses are a certain percentage of revenue, or if they will grow over time by clicking on the 3 dots next to each expense and selecting “edit”.

You can estimate your individual expenses by performing internet searches specific to your area. You might also consider calling companies like insurers or internet providers to talk about your potential expenses.

Assets

Many items purchased to get an Airbnb up and running should be entered as assets on the Assets page. Assets for an Airbnb might include:

- Any property purchased to use as a rental

- Furniture

- Sheets, towels, pots and pans

- Bikes or other equipment that could be rented by guests

- New locks for closets and private areas of the property

- Any remodeling costs to get the space ready for guests

These assets are pre-filled for you on the Assets Page in Airbnb. All of these assets will depreciate over time, so they will be slowly expensed over the number of years you choose. To edit an asset, hover over the row, see the 3 dots on the left of the asset name, hover over the dots, and click edit.

Liabilities

If you take out mortgage to obtain a rental property or get a business loan to cover start up costs, you will want to enter these liabilities on the Liabilities page. The interest and principal paid on these loans will then be considered in the financial reports ProjectionHub will produce.

Investors

Next you can add any personal investment you will be making as well as investment from outside investors. Simply go to the investors tab and click “add investor” and choose from our list of potential investor types. If you have any investors (including yourself) who will contribute cash before your Airbnb begins operating, be sure to put the cumulative total cash balance invested in the “initial cash” box on the Business Info page. You can access the business info page by clicking the name of your Airbnb on the top left and selecting “Business Info” from the menu.

Reports

Once you enter in all your assumptions you will be able to review your financial reports, including a Statement of Cash Flows, a Balance Sheet, and an Income Statement. Additionally, ProjectionHub provides some summary financial data, as seen below:

On the Dashboard page you will be able to download your projection Income Statement, Balance Sheet and Cash Flow projections to share with your lender or investor.

Adding Multiple Airbnb Properties

Finally, let’s assume you want to add more rental properties to your portfolio. All you need to do is go back to the “Business Model” page and add another “Airbnb” business model. You can add as many units as you would like over time.

Again, you can get started by creating a ProjectionHub free trial account today.

As you complete your projections please don’t hesitate to reach out to us with questions at support@projectionhub.com or view our other financial templates including our 2 sided marketplace revenue model.

Good luck!