It seems like a no-brainer right? The house down the street has been on the market for 24 months and the price continues to go down, and you just know that you could get a mortgage, buy the house and rent it out at a profit.

Before you put in your 2 weeks notice at your stable job, let’s just run some numbers and look at the realities of the rental home economics.

The goal of this blog post is to walk you step by step through the thought process for creating financial projections for your rental home business. I will be using our financial projection web app – ProjectionHub – and then at the end of the post I will share an Excel template you can use to create a financial model for your own rental home business.

Step 1 – Finding a Home to Purchase and Rent Out

The first thing to do is find a home that you can purchase and that you think you will be able to rent out to a tenant. A good place to start is the real estate website – Zillow. Using Zillow you can find a few key pieces of information:

- What houses are available

- How much do they cost to purchase

- Rent price listing for a similar house nearby

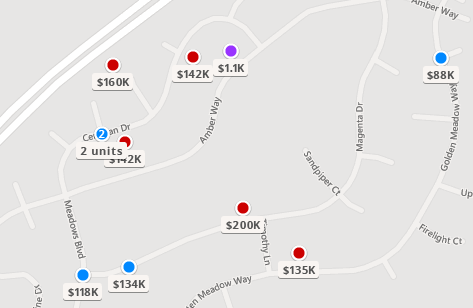

Below you can see a screenshot from Zillow with homes that are listed for sale along with prices. You can then do a similar search for rentals nearby and find listed rental prices to get a feel for what the market rent is for a similar home.

So let’s say you identify a $100,000 house that you will purchase, next you need to determine how much you can charge for rent.

Step 2 – Set a Rent Price

According to an article by Home Guides landlords should charge between .8% and 1.1% of the value of the home as the monthly rent. So for your $100,000 house you can expect to charge between $800 and $1,100 per month. Let’s assume you are able to demand $1,000 per month in rent.

Step 3 – Estimate a Mortgage Payment

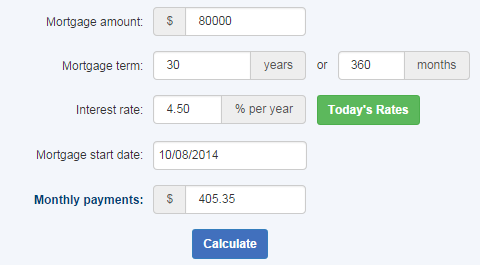

As a general rule of thumb you will need to come up with a 20% down payment to purchase a home for the purpose of renting it out. So you will need to invest $20,000 in cash into the home right off the bat. Then you will have an $80,000 mortgage. Your monthly mortgage payment would be around $400 per month according to Bank Rate’s Mortgage Calculator:

Step 4 – Estimate Normal Monthly Expenses

Your operating expenses will include the following:

- Property Taxes

- HOA Fees

- Lawn Care

- Insurance

- Maintenance

There is an excellent article on Zillow that helps you estimate your rental property expenses. As a rule of thumb they suggest that your monthly expenses excluding your mortgage payment will be 35% to 80% of your monthly rent. So in this case, let’s say you end up on the low end and it costs you 40% of your $1,000 monthly rent. Now you have $400 in a mortgage and $400 in operating expenses. This leaves you $200 per month in profit, but we have not considered unexpected expenses yet.

Step 5 – Budget for the Unexpected

So you have $200 in profit per month right? Sounds pretty good… until the furnace goes out, or the roof starts to leak, or the refrigerator dies, or the tenants notice that you have termites, etc, etc. As a rule of thumb Zillow suggests that you budget 1% of the value of the home per year for maintenance and miscellaneous expenses. So for a $100,000 home you should expect $1,000 per year for those unexpected expenses, or $83 per month. But you need to remember that these expenses won’t come in $83 increments. You may not have a major expenses for months or even a year, and then all of a sudden you may need to dish out $3,000 for a new furnace.

Creating a Financial Projection for a Rental Home

Now that we have all of the data we need I entered it all into our financial projection tool to come up with a 3 year financial projection.

The Result?

The rental home business is a long term game, and the economics improve as you increase the number of properties you own. Really the goal for rental home owners should be to pay off the mortgage as fast as possible because when you no longer have a mortgage payment, that extra cash flow is yours to keep. Secondly, with just one property it is really just a game of luck. Will the furnace last another few years? Will the roof hold up? Will the termites stay away? Will a pipe burst? When you only own 1 property if anything bad happens during the year, there goes all of your profit. If you own 100 properties, the averages will play out and you should be able to make a nice profit, but with just a few properties anything can happen.

Our projections show that you will have a net loss on this house every month, but that is because of depreciation expense. You will have a positive cash flow of a couple hundred per month on average. But with only one house, you won’t get rich quick.

I used our financial projection tool to model this rental home business, and I have published the resulting Excel template here for you to download and use for your own projection.