Many salons and barber shops are structured with a booth rent model, this can be a challenging business model, but it can work if you are diligent in modeling your financials to determine your breakeven point for the salon.

The following is a description of how you can create financial projections for a Salon or Barber Shop with a booth rent model using ProjectionHub.

Sales Projections

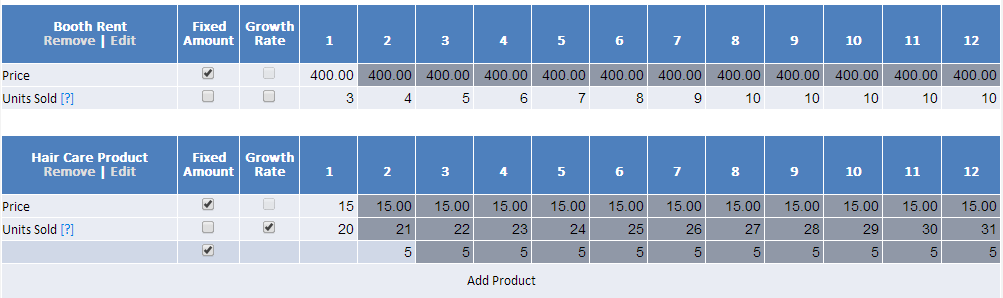

First, we are going to create sales projections for the Booth Rentals and then sales projections for the Product sales.

So I added Booth Rent as a product. You could also choose to add it as a service with a monthly sales cycle, but I chose product. So as you can see I set the price for booth rent at $400 per month, and I am assuming the salon has 10 booths. So in month 1 the salon will only start with 3 booths rented, but will add 1 renter each month until the salon reaches capacity in month 8.

Then for sales projections for Hair Care Product, rather than add every single product that the shop might carry, I am just going to make one projection for all hair care products. I am going to assume that the average sales price per unit is $15. In month 1 I am assuming that I will sell 20 units and then I added a 5% monthly growth rate for retail sales. So by month 12 I expect to sell 31 units.

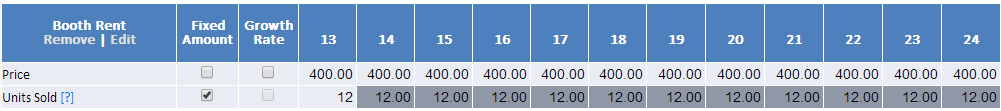

Sell the Same Booth Twice?

Now after year 1, maybe I realize that 2 of the booths that are currently being rented are sitting empty most of the day. Maybe those two particular stylists only come in at night. So you decide to sell those booths twice, so now you only have 10 booths, but 12 renters as seen in the year 2 sales projections below:

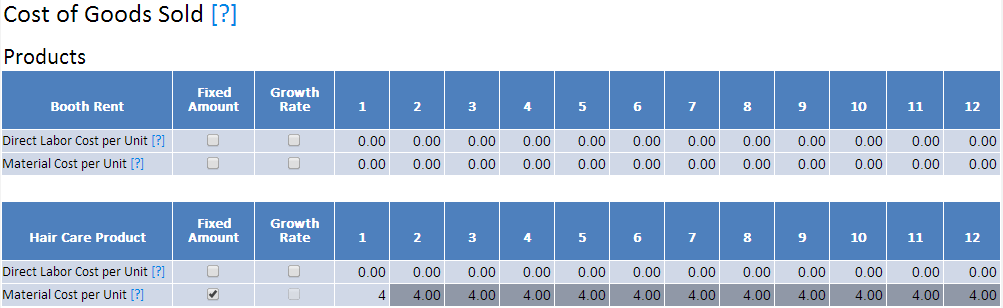

Cost of Goods Sold for Barber Shop

The next screen that you will see on ProjectionHub will ask for your Cost of Goods Sold. For booth rent there will be no cost of goods sold. For the hair care product I am assuming an average cost to purchase the product of $4 per unit.

Booth Rental Salons may or may not have any employees to manage the salon. It is probably most likely that the owner just manages the salon.

Overhead Expenses

Now it is time to enter monthly overhead expenses for the salon. Here are the expenses I think are probably pretty common:

- Accounting – $100/month

- Advertising – $75/month

- Insurance – $25/month

- Office Supplies – $25/month

- Telephone – $60/month

- Internet – $40/month

- Rent – $850/month

- Utilities – $100/month

- Website – $25/month

- Owner Draw – $2,000/month (the owner needs to make something for the work and effort, but maybe won’t take an owner draw until month 8 when the salon reaches rental capacity.)

Startup Costs

Next we need to add the other 1 time startup costs and the sources of startup funding.

Let’s assume that you will want to purchase $3,000 worth of inventory to get started, you will need to purchase sinks, chairs etc for 10 booths which we will assumes costs $20,000 you will want $10,000 in cash in the bank, and will have $2,000 in additional one time startup costs like a sign, and legal fees.

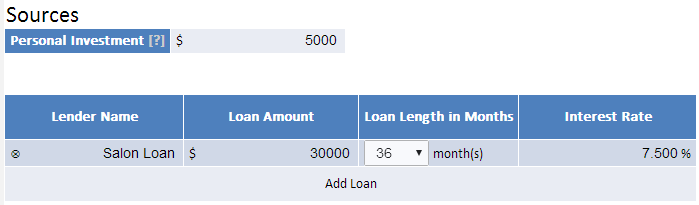

Sources of Funding

Let’s assume you are going to try to get a loan for your startup to fund the $35,000 in startup cost and cash reserve requirements that you have. You might start by looking at this list of SBA Microlenders who specialize in making small loans. Let’s assume you are successful in securing a $30,000 microloan and you invest $5,000 of your own savings.

Finally, ProjectionHub will ask you how much inventory you expect to keep on hand as a percentage of your monthly sales. I am going to assume that you keep at least 1 month of inventory on hand at all times so you would enter 100% of monthly sales as your inventory level.

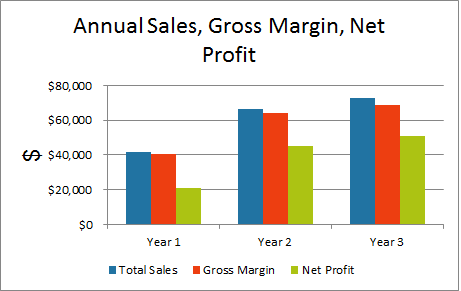

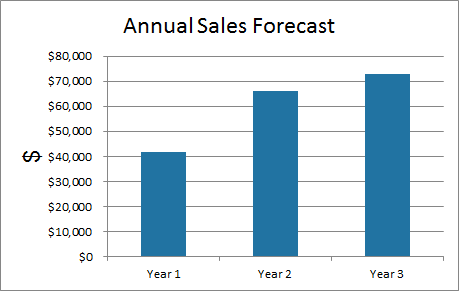

Now you are ready to download the file and take a look at your completed projections. Based on the info we entered, here are some of the graphs that ProjectionHub produces:

So, are you ready to create your own financial projections using ProjectionHub? Or would you simply prefer to download the Excel template here?