I got a call today from a pastor who has planted a new church and is going through the process of becoming a 501c3 non-profit and just so happened upon my blog post – Creating a Startup Budget for a New Church Plant.

He was looking for some help in creating a set of financial projections as part of the process of completing IRS Form 1023 – which is required in the application process to become a non-profit. As I was looking at the Form 1023 I realized it was quite confusing for the “non-accountant” so I wanted to write this blog post to help other non-profits complete the financial data section of the 1023.

This blog post is going to focus on organizations in existence for less than 5 years. If you have been operating 5 years or more, the requirements are slightly different in terms of the financial data section.

Completing Form 1023 Financial Data for a New Non Profit

Step 1 – Determine How Many Years of Projections you Need

According to the IRS, you need 3 years of projections if you have not filed a tax return in the past, and you need 4 years of projections if you have completed at least on tax year. If you have been operating for 4 years or more, then you don’t need projections, you just need to show your last 4 years of financial records.

Step 2 – Using ProjectionHub to Create your Standard Financial Projections

To create your financial projections in the first place you will want to take a look at our non-profit financial projection template to help give you a head start. Here is a video demo to walk you through filling out the projection template for IRS form 1023:

Step 3 – Add Non Profit Revenue Forecast

Next you will need to add your revenue projections for your non profit. Our template in ProjectionHub has each revenue line item from the form 1023, I have listed those categories below and provided some explanation:

- Gifts, grants, and contributions received – This would also include donations.

- Membership fees received – Non profit associations or other groups will probably receive membership fees.

- Gross investment income – For large endowments or foundations they will probably generate significant gross investment income.

- Net unrelated business income – This is income that you generate that is not directly tied to your mission.

- Taxes levied for your benefit – This would be if taxes are levied by the IRS and then given to you.

- Value of services or facilities furnished by a governmental unit without charge – This is essentially in kind services that you receive and count as revenue, but will not actually receive cash for.

- Any revenue not otherwise listed – This can be a catch all other revenue section.

- Gross receipts from admissions, merchandise sold or services performed, or furnishing of facilities in any activity that is related to your exempt purposes

- Net gain or loss on sale of capital assets – For example if you bought a building and sold it at a profit, you would record that gain on the sale as revenue.

- Unusual grants – This is pretty straightforward, just grants that our out of the norm for the organization.

Step 4 – Add Expense Forecast

Now add your expenses for each month:

- Fundraising expenses – This could be travel, fundraising salaries, and fundraising event expenses, etc

- Contributions, gifts, grants, and similar amounts paid out – If your organization provides gifts or grants to others, those expenses would be included here. For example, a Church might provide gifts to members who need financial support, or a foundation might give grants to other non profits.

- Disbursements to or for the benefit of members – This could be a disbursement to a church member for financial assistance.

- Compensation of officers, directors, and trustees – Salaries and wages.

- Other salaries and wages – All other salaries and wages for those other than fundraising salaries and salaries of officers, directors, and trustees.

- Interest expense – Interest on any loans.

- Occupancy – These are expenses like rent, utilities, etc.

- Depreciation and depletion – Depreciation on buildings, vehicles or other assets.

- Professional fees – Attorney or accountant fees.

- Any expense not otherwise classified, such as program services – All other expenses.

Step 5 – Convert Projections from Template to Form 1023

Next, you will be able to take your non-profit or church financial projections from our template and then enter those numbers into the form 1023.

Step 6 – Add your Current Balance Sheet to Form 1023

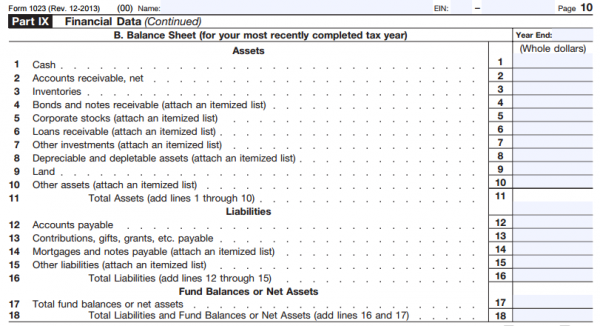

You will also need to add your current balance sheet to Form 1023. Our free balance sheet template could be a great starting point along with this video tutorial to help you fill it out.

Once you fill out your balance sheet template, you can enter in your current balance sheet into the form 1023 as seen below:

Once that is complete you should be well on your way to completing the financial data section of your Form 1023. If you have any questions at all please don’t hesitate to reach out to me to ask specific questions about your application to become a non-profit. I would be happy to help – Adam Hoeksema – support@projectionhub.com

Leave a Reply