Two of the hottest startups in the world right now are 2 sided marketplaces – Airbnb and Uber. We know that marketplaces can create incredible value when they reach scale (think ebay, Amazon, Uber). But we also know that 2 sided marketplaces are incredibly difficult to reach scale.

Two of the hottest startups in the world right now are 2 sided marketplaces – Airbnb and Uber. We know that marketplaces can create incredible value when they reach scale (think ebay, Amazon, Uber). But we also know that 2 sided marketplaces are incredibly difficult to reach scale.

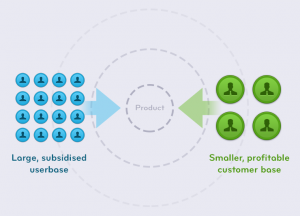

The reason it is so difficult to start a 2 sided marketplace startup is because it is essentially like starting two different businesses. You have 2 different customers. You must have buyers and sellers at the same time. This is why many marketplace businesses start with very narrow niche industries. For example, eBay started with Pez dispensers. As you grow you will likely need to subsidize one side of the marketplace. For example, sellers might be willing to pay for more buyers. There is a great Harvard Business Review article on 2 sided marketplaces that discusses subsidization of one side of the marketplace.

There is likely some very complicated math that would tell you what percentage of your users need to be buyers and what percentage need to be sellers. Every marketplace is going to be different. Here is a Quora Question and Answer that identifies some of the key questions that determine what percentage of buyers vs. sellers you will need on your platform.

As an example, let’s look at a seller on eBay and a “Seller” on Uber.

A seller on eBay might have 200 units of a given product in stock. Each buyer might only need one of those products, so a given seller on eBay might be able to support 200 buyers at a time.

Uber on the other hand is quite different. A “seller” which is the driver in this case can only drive 1 or 2 buyers around at a time. It is likely that you might need a higher percentage of sellers on Uber than on eBay.

As a startup you probably aren’t going to know the perfect mix of buyers vs. sellers, so you are going to have to make a hypothesis. You can then advertise to secure a critical mass of buyers and sellers in a particular market. In just about any marketplace business, it is important to dominate a niche market initially, and then grow from there. (Zero to One by Peter Thiel is a good read on this topic)

Ok so let’s get into the financial model now. I am going to assume that you have figured out/or made a hypothesis to estimate the breakdown of buyers vs. sellers that you should have. And for this revenue projection, we are going to focus on the buyer side of the market.

You can download the Marketplace Financial Projection Template that I created, and follow along.

Let’s get started:

Step 1 – Estimate your Market

Start by estimating the size of your market. Let’s say you are starting a platform for employers to find graphic designers straight out of college. So graphic design students would create a profile and employers would pay to be able to view the profiles and contact students that they might like to interview. You could say that your total market is all employers that need graphic designers, and all graphic design students.

Step 2 – Narrow Down to a Target Market

You should probably start with a target market first. Maybe your target market is only graphic design students in San Francisco, and the target employers are tech companies in silicon valley.

Step 3 – Estimating Leads

So if your marketplace is a web based platform, then your leads are website visitors. You will need to estimate how many people you think you can get from your target market to visit your website.

Step 4 – Conversion of Leads to Users

Some percentage of those website visitors will turn into users. You will need to estimate a conversion rate.

Step 5 – Retention of New Users

Once you estimate new user signups, you will need to estimate how many of those new users will just drop off and never use the platform, and how many will continue on as active users.

Step 6 – Average Purchase $ Amount

The next step is to estimate the average dollar amount per purchase. Are users purchasing $25 Uber rides? Or $2,500 Airbnb vacation rentals?

Step 7 – # of Purchases Per User Per Month

How often will an active user purchase? An active user of Airbnb might purchase once a year while an active user for Uber might purchase once a week or even everyday.

Step 8 – Flat Fee Charge Per Purchase and/or % of Purchase Price Charged as Commission

Now we are finally getting to platform revenue. Typically marketplace platforms will charge a flat fee per transaction, a % of the purchase price, or both.

This process will give you a base model to get an understanding of your financial potential. It will also help you understand the economics of the platform, how many users you might need in an area to breakeven, etc.

Once you have your base revenue projections complete you can complete the rest of your financial projections using our ProjectionHub platform. Please feel free to reach out if you have any questions – adam@projectionhub.com

Leave a Reply