Based on some data from Fundivo, there are 23 million small business loans outstanding in the US totaling nearly $600 billion in outstanding loan balances. But the problem is that for every small business that is able to get a small business loan there are probably several that can’t! According to a report from Biz2Credit the average loan approval rate for small business loan applications was just under 12% in 2015, so clearly many small business owners wast a lot of time applying for loans that they ultimately don’t get.

How Likely is your Small Business Loan Application to Get Approved?

So rather than spend days gathering all of your company documents, financial statements, tax returns, etc in order to apply for a small business loan, just to get denied, why don’t you spend 60 seconds grading your chances of approval with MicroloanGrader.

As my day job I manage the 2nd largest SBA Microlender in the United States – Flagship Enterprise Center. We have developed a free tool to help business owners predict their chances of approval before they waste time applying for a loan.

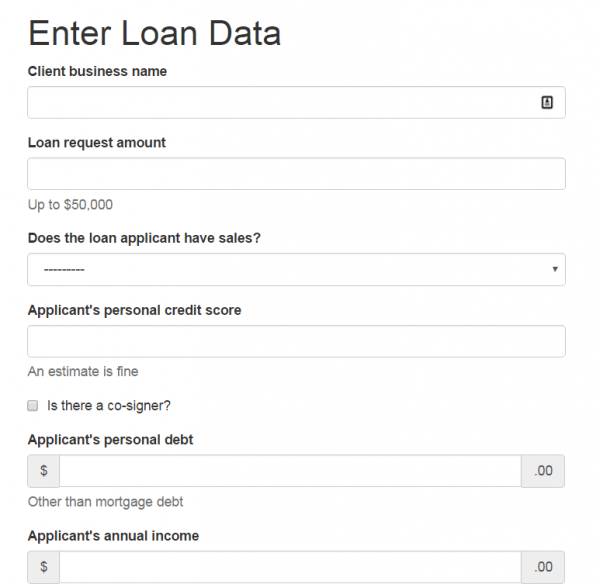

MicroloanGrader asks for 10 data points, 10 numbers, that will allow the system to give you a letter grade A through F.

- If you grade an A you are ready for the big leagues. You should head to your bank and apply for a traditional bank loan.

- If you score between a B and C you should look for your local SBA Microlender on this list, and apply there.

- If you score between a D and an F there are probably some things you need to work on before you waste your time applying for a small business loan. A couple of ideas include:

- Find a co-signer

- Find more collateral to pledge for the loan

- Work on improving your credit score

- Get a day job where you can earn some outside income

Now I should note that MicroloanGrader works best for… well Microloans. So make sure to enter a loan request of $50,000 or less. If you have a larger loan request, just enter it in as $50,000 which should give you a good idea of your grade even for a larger loan.

Check out MicroloanGrader

Here is a screenshot of MicroloanGrader which will give you an idea of how it works:

I hope this tool helps you determine whether you should spend your time looking for a small business loan, or if you you should be focused on finding an investor or a friend or family member to lend to your small business. Of course, if you score well and decide to apply for a loan from your bank, we would love for you to check out our tool ProjectionHub to create financial projections for your lender.

Best of luck!

Leave a Reply