The online mattress company Casper is making headlines for its upcoming IPO. Casper founders are intent on a $1 billion valuation, having famously turned down a $900 million offer from Target last year, but many analysts are predicting Casper won’t come even close enough to $1 billion to get a photograph. Why don’t the experts think Casper will achieve their goal valuation? For starters, they’ve never made a profit, and they don’t plan to do so anytime soon.

According to Bloomberg, in 2017 the funds raised by unprofitable companies in IPOs exceeded funds raised by profitable companies for the first time this century. Since 2017, that gap has only grown, with unprofitable giant Uber dominating both the news cycle and market value at IPO. At a glance, Casper doesn’t look much different from its unprofitable tech cousins, so why do analysts think Casper was a bad investment for its current funders?

As it turns out, many investors, eager to get in on the ground floor of the next Facebook or Alibaba have overlooked some key issues with Casper’s financials. We decided to run the publicly available information through our financial projection models to see if Casper ever has a chance at turning a profit.

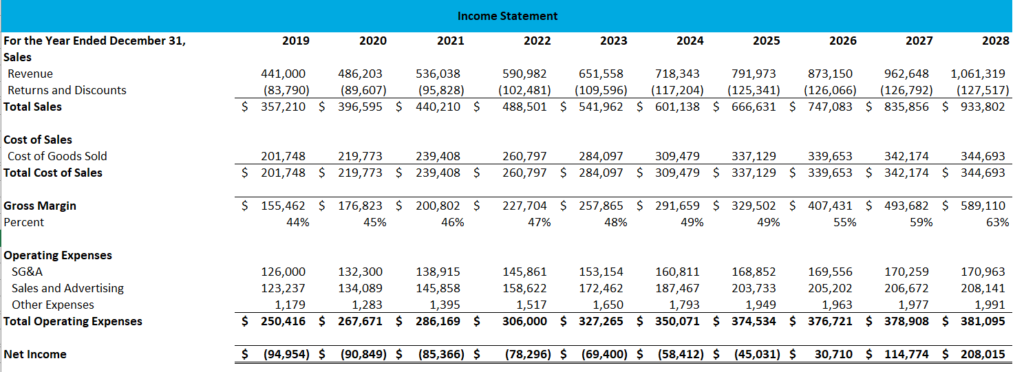

We started by entering the FY 2019 financials into our model (with a few minor changes due to rounding). We noted the following patterns based on available data:

Sales returns and discounts are almost 20% of total sales (sounds high, but a mattress does seem like one of those things you might not like if you haven’t sat on it in stores).

Cost of Goods Sold is about 56% of net sales.

Sales and Advertising Expense is about 35% of net sales.

Selling, General, and Admin expenses are about 36% of net sales.

Before flipping to our projected income statement, the financials are already not looking good. Sure enough, Casper lost $93 million in 2019, due to the fact that costs were 127% of net revenue. For a future profit to seem likely, some serious cost-cutting measures need to be made.

So, we decided to see just how drastic the changes would need to be for Casper to turn a profit. We started with the following plan:

- We decided to increase sales and marketing expense by 5% annually (from $127 million in 2019) since most analysts agree Casper’s revenue is driven largely by their clever advertising campaigns. Right now, Casper gets about $2.8 in net revenue for every dollar spent on advertising.

- We increased the revenue dollars generated by each advertising dollar by 5% each year, assuming advertising campaigns become more effective over time.

- We allowed COGS as a % of net revenue to decrease by 1.2% per year, assuming there are some economies of scale as sales rise.

- We decreased SG&A and other expenses by 2% each year (so they become a smaller % of sales, even while the dollar value of the expense increases over time).

Even with these measures, we still predict Casper won’t turn a profit until 2026, as shown below. They will lose $522 million after their IPO before turning a profit, which by many estimates could be the entirety of their IPO cash. In this case, money spent on R&D or other assets could very well bankrupt Casper before they see a single dime in the black.

While little financial information is available about Casper’s early years, one would suspect that the ratios of expenses to revenue were worse, not better at a smaller scale. If early investors in Casper had run a simple prediction like this one, they might have noticed what drastic leaps would have to be made to even approach profitability. Distant profits don’t point towards a favorable IPO valuation, and many early investors are no doubt regretting their lost potential returns. Of course, every big new idea comes with promises of dramatic changes ahead, and maybe Casper will be the one to prove us wrong and grow into a thriving public company.

About ProjectionHub – ProjectionHub is a software and professional services company that helps entrepreneurs create financial projections for investors, lenders and internal planning. We’ve developed a variety of templates including a marketplace revenue and financial model template to help you create investor-ready projections.

Leave a Reply