For the last decade I have worked in both small business lending, as well as working with entrepreneurs who are looking to raise investment. Specifically in my role as the Co-Founder of ProjectionHub we have helped thousands of companies create financial projections for their potential lenders and investors.

So today, more than ever, our small businesses on main street as well as our high growth tech companies have the same question. How long can my business survive like this?

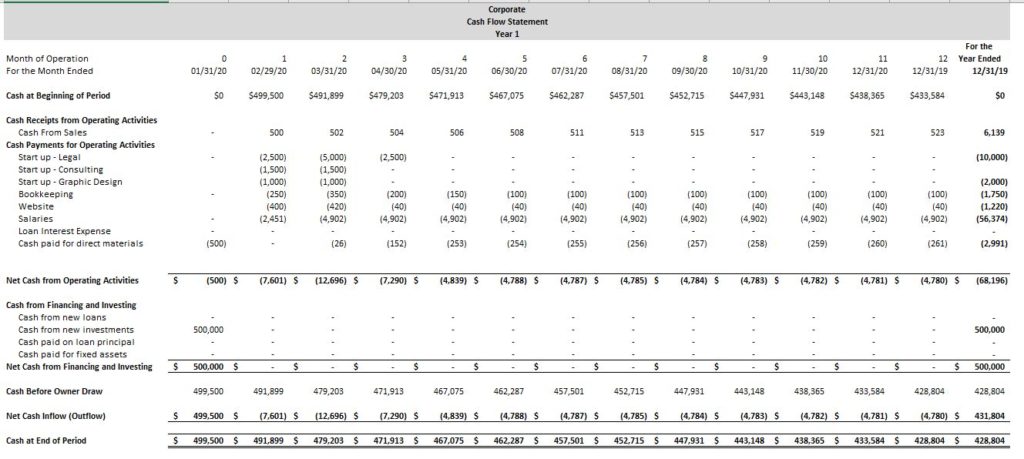

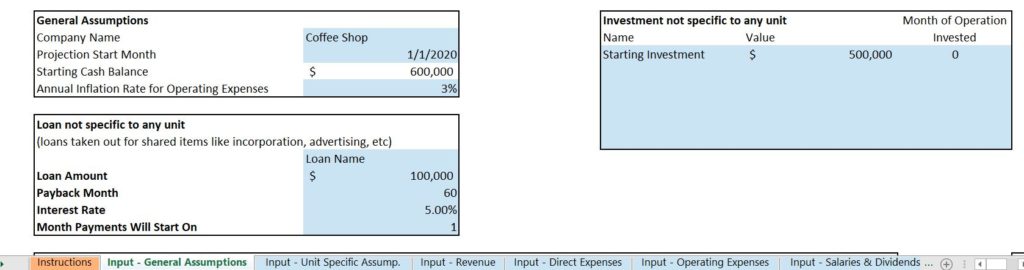

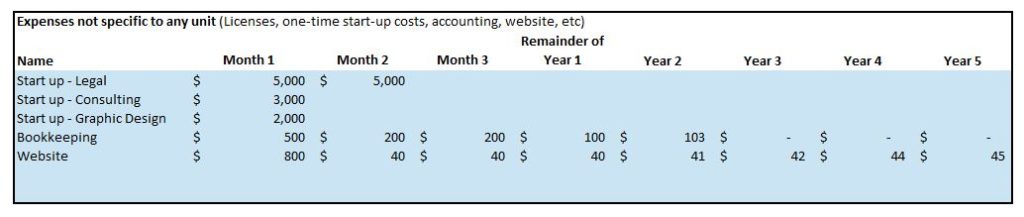

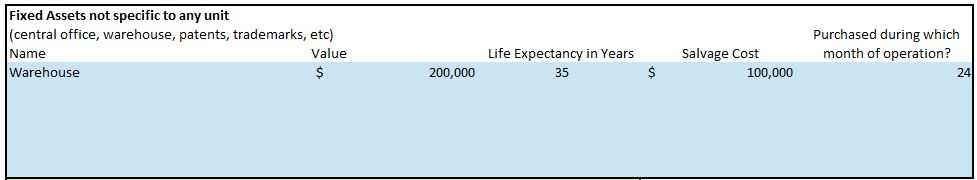

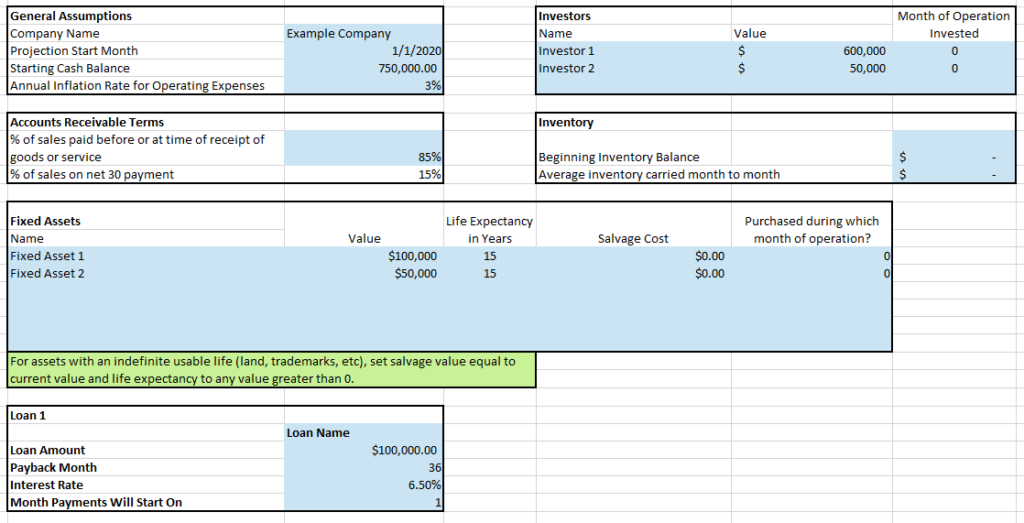

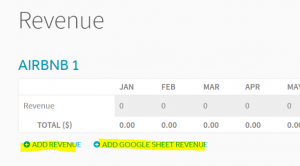

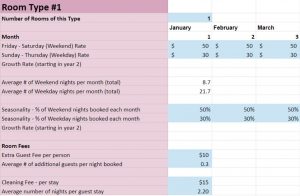

In an effort to play our small part in helping companies survive the COVID-19 pandemic we built a simple spreadsheet tool that we are making available for free to any business that we hope will help you do some cash flow planning.

Now what I want to do is just walk you through how I am advising my clients and then how I hope our spreadsheet tool can help you with your own planning.

So first of all, I believe there are essentially 2 categories of business right now that are negatively impacted by COVID-19:

1. Cash Flow Challenged Businesses – These are businesses that have a product or service that will continue to sell during a national lock down but may struggle with cash flow due to customers paying slowly, delaying purchase decisions, or the need to discount in order close deals.

2. Sales Challenged Businesses – These are businesses that will have no sales or dramatically less sales during a complete lock down or shutdown. These are restaurants, retailers, event based businesses etc that aren’t just facing a slowdown in business, but a 100% decline in sales overnight in some cases.

So what can you do?

This is an unprecedented time and there aren’t really textbooks to go to in order to figure out what to do, so these thoughts are just my own thoughts in a rapidly changing situation. For a sales challenged business, I think your goal is to figure out how to survive in order to be able to reopen when the lock downs are lifted. I think for many small businesses this will likely mean:

- Temporary layoffs of your employees

- Temporarily not paying nearly any of your bills

I know for many small businesses it won’t even be an option as to whether you can pay your bills, you simply won’t have the cash to continue paying rent, utilities, loan payments, employees, etc when you have no sales at all. In my mind your best bet is to just try to hibernate, take care of your employees as best as you can and take care of your family as best you can so that you have a chance to reopen when bans are lifted.

So for businesses in this situation calculating how long your business can survive is pretty simple:

Just take:

(Any sales that you still expect to have – any cost of goods sold expenses that are directly related to those sales) – Your absolutely necessary overhead expenses that you just have to pay each month = your cash burn per month.

Then take your current cash in the bank and divide by your cash burn per month and you will get a number of months that you can survive.

Now for cash flow challenged businesses we will go through a similar process, but a bit more complex. Let’s talk through it:

First, remember that a cash flow challenged business is a business that is still selling, there is still demand for your product or service, but maybe demand has reduced a bit, or maybe your supply chain is broken and you are having trouble getting inventory, or maybe your customers are just paying you very slowly during this time.

So the exercise can still be pretty simple:

List your typical cash received from sales in a given month, let’s say it is $20,000. Next list your typical cash outflows for a month. So just go through and list this line by line for various cash outflow categories. Essentially these will be overhead expenses plus loan payments.

- Advertising

- Insurance

- Wages

- Supplies

- Utilities

- Loan payments

- Etc

Let’s assume these cash outflows all add up to $15,000 per month.

Now you will have your Total Cash Inflows from Sales and your Total Cash Outflows from expenses and debt payments. In order to calculate how long you can survive without any changes we just need 2 more data points. Your Gross Profit Margin % and your current Cash Balance. Let’s assume your gross profit margin is 40% and your current cash balance is $15,000.

As a reminder on how to calculate your gross profit margin, let’s say you sell a product for $100 and it takes you 1 hour of labor to make the product at $15 per hour cost and it takes $25 worth of materials for a total cost of goods sold of $40. If you sell that item for $100 you have $60 of gross profit. $60/$100 means you have a 60% gross profit margin.

Now finally, let’s calculate how many months you can survive without making changes to what you wrote down so far.

The calculation will be:

(Cash Received From Sales X Gross Profit Margin %) – Cash Outflows from Expenses and Debt Payments = Cash provided from operations.

So in our example this would be ($20,000 x 60%) – $15,000 = -$3,000

So we are burning $3,000 in cash per month.

Now the final step to determine how many months of runway you have to weather this COVID-19 storm. Take your cash in the bank which we said was $15,000 divide by the $3,000 that you are losing each month and you will get 5.

You have 5 months at this pace before you are out of cash.

Now what I would suggest that you do is go back and start to play with different scenarios. What if you don’t receive the full $20,000 in cash from sales per month. What if your customers pay you slowly, or cut back. If for example you had a 50% drop in sales you would have a $9,000 cash loss each month and you would have less than 2 months of cash runway.

Then you can start playing around with cutting expenses to see how much extra time that gives you. Obviously you want to give yourself as much time as possible to weather this. We don’t know how long it will take for things to go back to normal, so please go through this exercise, use our template if it is helpful and prepare so that we can all get through this together!

Finally, as a reminder our cash flow template built specifically for you to figure out how long you can last during this downturn is free for you to download. I hope this was helpful to you, and please don’t hesitate to reach out to us at support@projectionhub.com

Thank you!