Creating a projected balance sheet for a startup can be an incredibly complex task. Do you know what the hardest part is? To get the balance sheet to BALANCE! I speak from experience because I spent hours and hours trying to get our financial projection model that is used with our financial forecasting tool – ProjectionHub, to balance and tie in with our projected cash flow and profit and loss.

Creating a projected balance sheet for a startup can be an incredibly complex task. Do you know what the hardest part is? To get the balance sheet to BALANCE! I speak from experience because I spent hours and hours trying to get our financial projection model that is used with our financial forecasting tool – ProjectionHub, to balance and tie in with our projected cash flow and profit and loss.

Although you could just use ProjectionHub or other Excel templates that help you create a balance sheet, this post is to help those of you that want to create a custom financial projection model and need to build your balance sheet from scratch.

Steps to Create a Balance Sheet Forecast

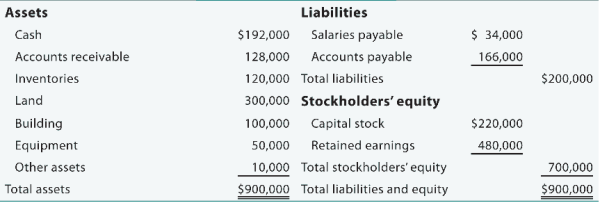

1. Format Your Balance Sheet – The first thing you need to do is format your balance sheet. In the simplest form all you need to remember with your Balance Sheet is that Assets = Liabilities + Owner’s Equity. You can see the basic line items that make up a balance sheet in the image below.

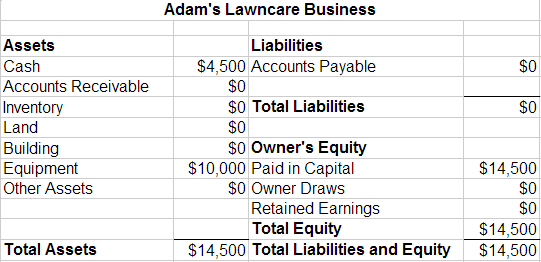

2. Enter Starting Balances – The first thing you need to do is enter starting balances. I am going to show you an example of a fictitious business called Adam’s Lawn Care. When I started the business my balance sheet was pretty empty as you can see below. All I had was a bit of cash in the bank, a lawnmower, and some “Paid in Capital” which was my personal investment into the company to purchase the lawnmower initially.

You can also see that the $4,500 in cash that I have also shows up in the Paid in Capital section as my investment into the company.

3. How Sales Impact the Balance Sheet

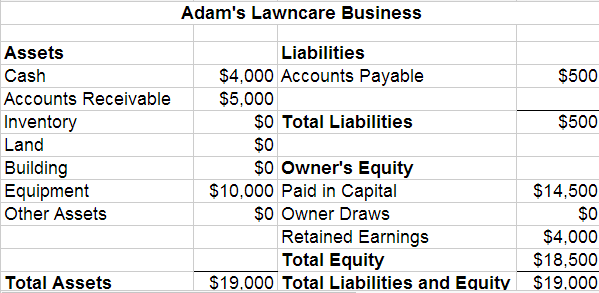

So the next thing that will hopefully happen with the business is SALES! So let’s assume I get a contract with 5 local businesses to mow their grounds. I will do the work, and then invoice the company and expect to get paid in 30 days. Let’s say that I charge each company $1,000 for the first month of work, so I would have $5,000 in sales, but the day after I invoice that does not show up as cash on the balance sheet yet. Instead it shows up as Accounts Receivable.

4. How Expenses Impact the Balance Sheet

In the process of generating those sales I will have some expenses like fuel, oil, meals, etc. Let’s assume that I have $1,000 worth of expenses half of which I paid with cash, and the other half I paid with a credit card. So let’s see how that changes my balance sheet.

Now you will also notice above that Retained Earnings went up to $4,000. Retained earnings is all of your cumulative net profit or net loss. So as of right now I have $5,000 in income and only $1,000 in expenses so I have a $4,000 net income that flows through to retained earnings on the balance sheet.

5. How Does a New Loan Impact the Balance Sheet

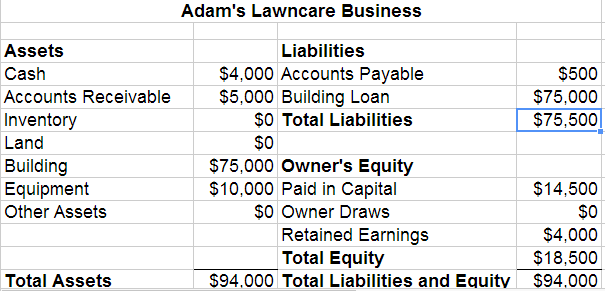

Finally I want to show you how the balance sheet changes when I buy a small office for my business. I had to get a loan from the bank to purchase the building, so my liabilities increase by the loan amount of $75,000, and my assets increase by the price of the building, $75,000.

I hope this has been helpful to see how different transactions impact the balance sheet. As you are creating your own financial model, just remember that each transaction that impacts an asset, must impact a liability or equity account equally so that you always stay balanced.

If you have any questions please feel free to email me at adam@projectionhub.com and I would be happy to help.

Photo by RODNAE Productions from Pexels

At the end of the day it all comes down to one question. Any potential small business lender is going to ask one ultimate question that will decide the fate of your loan application. That question is: “will we get our money back?” There are 3 ways that a small business lender can recoup funds from a borrower, and if you can prove that you can repay the loan from at least 1 of these 3 sources, you will likely get approved for a loan.

At the end of the day it all comes down to one question. Any potential small business lender is going to ask one ultimate question that will decide the fate of your loan application. That question is: “will we get our money back?” There are 3 ways that a small business lender can recoup funds from a borrower, and if you can prove that you can repay the loan from at least 1 of these 3 sources, you will likely get approved for a loan. A few weeks ago we released our updated version of

A few weeks ago we released our updated version of