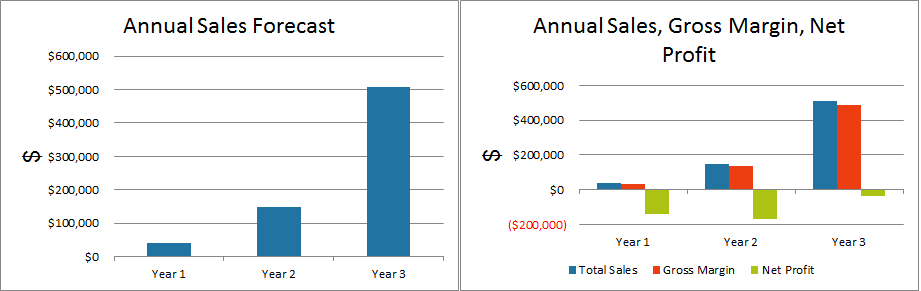

According to a Harvard Business School study and a Wall Street Journal article 30 to 40% of VC-backed startups completely fail, lose all of their investor money and are forced to liquidate. 95% do not ever reach the level that they initially projected when raising capital.

According to a Harvard Business School study and a Wall Street Journal article 30 to 40% of VC-backed startups completely fail, lose all of their investor money and are forced to liquidate. 95% do not ever reach the level that they initially projected when raising capital.

This is an important stat for angel investors and VCs to know. I believe this is an unacceptable stat. There is no reason for this to be the case. Investors should demand more realistic financial projections. I understand that no one can tell the future, but with the data available on the web these days startups should be held to a higher standard. A simple search on Quora can give you a great outline on how to create realistic forecasts for your startup. Not to mention most companies that are raising VC money already have a lot of sales and traction and data to base their projections off of.

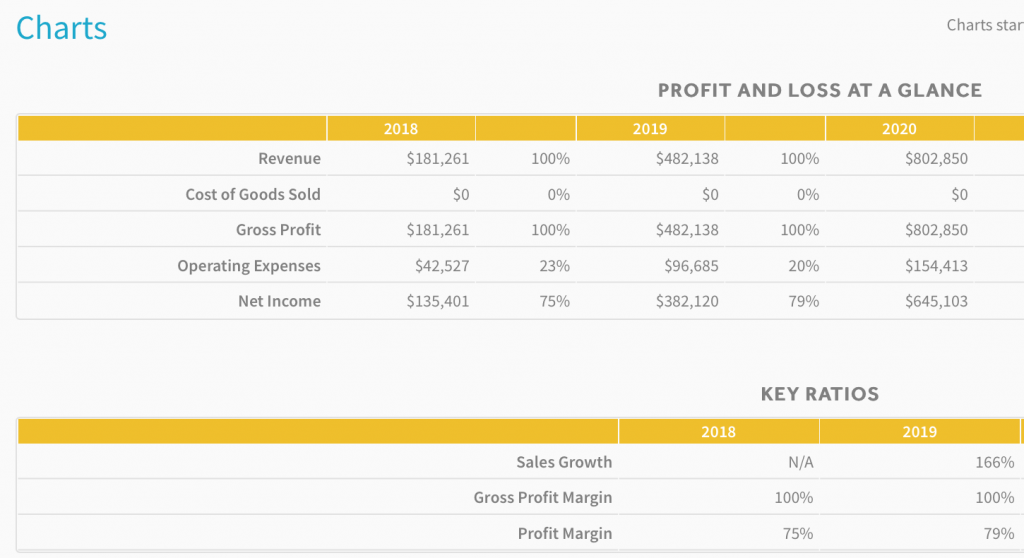

Unrealistic projections are costing investors billions of dollars a year, I think ProjectionHub can help solve this problem by holding entrepreneurs to a higher standard. We are currently working on developing a scoring model to grade whether our user’s projections are actually realistic.

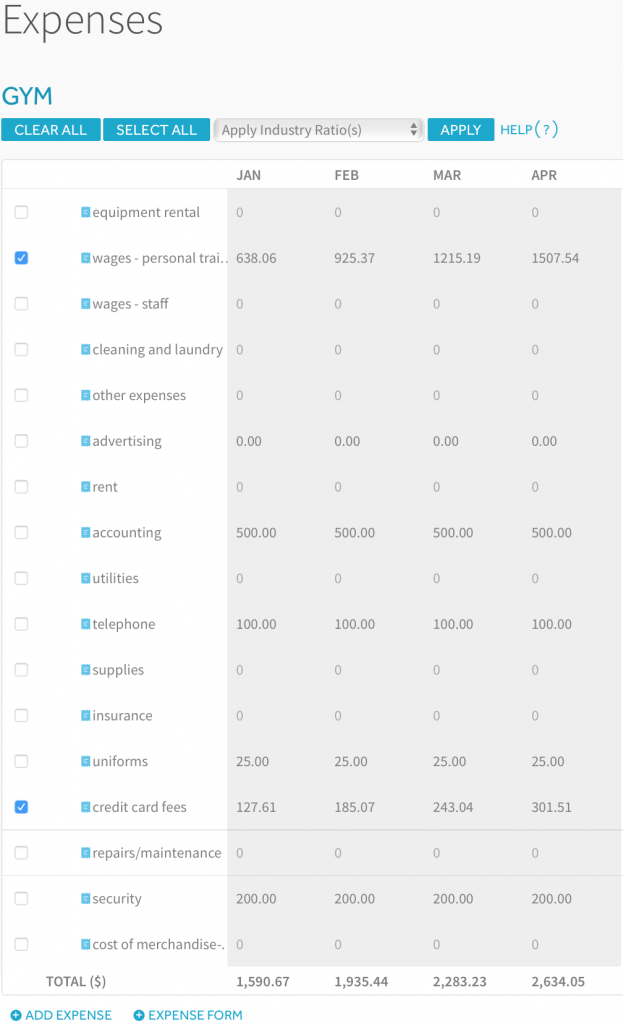

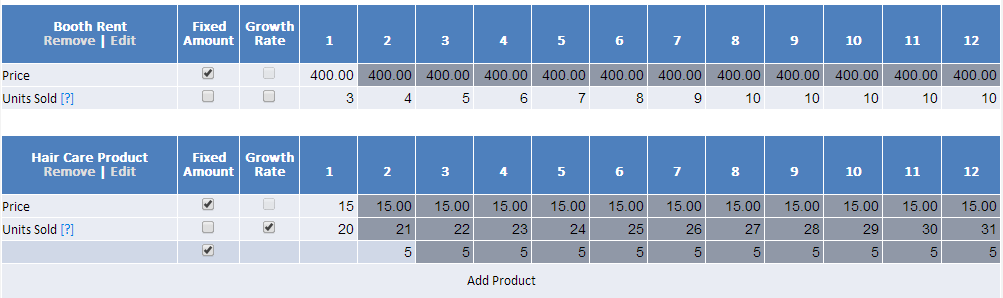

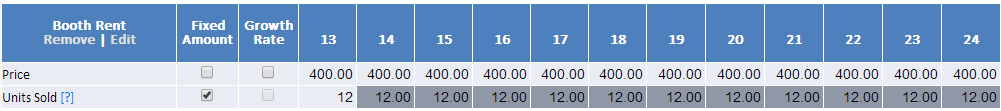

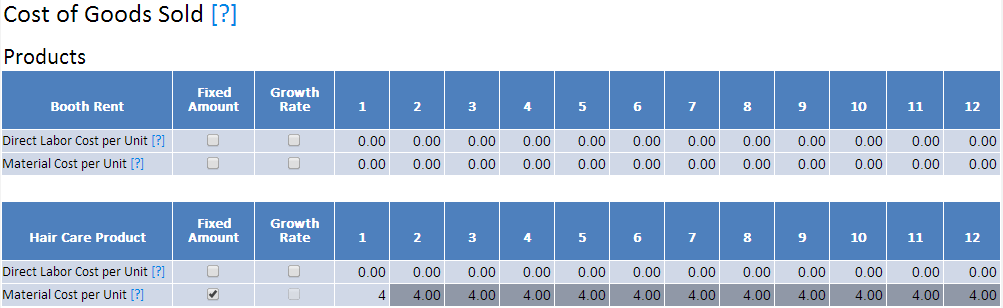

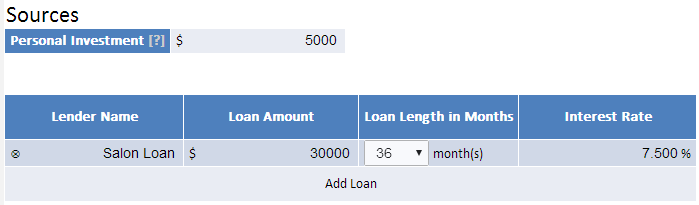

It will definitely be more difficult to determine what is realistic for technology startups than for small businesses in well established industries. For example, a financial forecast for a salon is always going to follow a similar pattern, a restaurant should always be able to keep labor costs and food costs within a certain percentage of sales.

As an example, we hope to work with an industry data benchmarking partner like BizStats to help provide our users with realistic percentages for various expenses based on their specific industry. By improving the accuracy of forecasting, we believe we will help save investors and business owners billions of dollars each year by keeping them from investing in unrealistic financials.

As the manager of a microloan program I review dozens of small business financials every month. One of the most common mistakes I see that really hurts a company’s chances of securing a microloan is when they categorize their inventory purchases as an expense.

As the manager of a microloan program I review dozens of small business financials every month. One of the most common mistakes I see that really hurts a company’s chances of securing a microloan is when they categorize their inventory purchases as an expense.

According to the

According to the