Archives for August 2017

Salon Financial Projections: Where do you Start?

According to a report released by the Small Business Development Center Network there are approximately 82,000 salons in the United States alone. If you are looking to start your own salon and seeking a business loan from the bank, they will probably ask you to complete a set of financial projections.

According to a report released by the Small Business Development Center Network there are approximately 82,000 salons in the United States alone. If you are looking to start your own salon and seeking a business loan from the bank, they will probably ask you to complete a set of financial projections.

If the thought of a spreadsheet and financial model gives you a headache, then this article is for you!

Steps to Complete Financial Projections for a Salon

There are a number of things to consider as you develop your financial model. The goal is ultimately to demonstrate to yourself and your potential financial partners like the bank or an investor that your Salon concept is financially viable and will generate positive cash flow. Here is the process:

Step 1 – Choose your Business Model – Booth Rental vs. Employee Stylist Model

As you know, there are effectively 2 different financial models for a salon. Either you rent booths to stylists who pay you the same weekly or monthly rent for their booth, or you employ the stylists. I don’t need to go into the pros and cons of each model, this article already does a good job of that from the booth renter’s perspective.

From the salon owner’s perspective the booth rental model is less risky, but the upside potential is also much lower. Whether you have the most successful salon in town, or the least successful salon, you will make about the same amount of revenue from the booth rental model, but if you are highly successful and the stylists are your employees you will make a much higher profit.

The ProjectionHub App has a template already built for you for both business models:

Step 2 – Build your Revenue Model

Once you decide on a business model, you will need to build out your revenue/sales model. This process should essentially model how you expect to acquire customers, how much they will pay and how many will come back and how often. Here is an example of how I would model both a Booth Rent Salon and a Commission Based or Employee Based Salon:

Booth Rent Salon Revenue Model

You will need to make the following assumptions:

- What % of your booths will be rented at full capacity each month?

- How much do you charge for booth rent per month?

- How many booths will you have available for rent?

That is about all that you need to project your monthly revenue for a booth rent model.

Commission/Employee Based Salon Revenue Model

The revenue model for a salon where you employ the stylists and then pay them wages plus commissions is a much more complicated model, but also has the potential to be more profitable. You will need to make the following assumptions:

- What is your monthly marketing budget to attract new customers to the salon?

- How much in advertising costs do you have to pay in order to attract 1 new customer?

- How many “free” new customers will come to the salon each month that just hear about the salon through word of mouth?

- What percentage of new customers will become “active” customers meaning they continue to return on a regular basis?

- How often will an active customer visit the salon?

- How much will an average customer spend per visit?

With these assumptions in hand you should be able to complete your revenue projections. If you need some help actually building this out in Excel and creating custom financial projections for your salon, we can help, tell us more about your salon here and we can work to help!

Step 3 – Project Expenses as a Percentage of Revenue

There are essentially 2 ways that you can project expenses for a salon. You can project specific expenses for various expense categories, but it may be easier to simply project your expenses as a % of revenue.

Step 4 – Add Business Loans or Investments

It is quite likely that the reason you are creating financial projections in the first place is because you are looking to get a loan or securing funding from an investor. So you will definitely want to add your projected investment or projected loan into your projections. With ProjectionHub you can add a loan and it will automatically add your monthly interest and principal payments into your projections for you.

Kabbage, and many other lenders, offer loans for salons specifically, you can learn more about their salon loan options here.

Step 5 – Gut Check your Projections Compared to the Industry

According to Small Business Trends the average net profit margin is 8.78% so if you are projecting a net income of 25% of your sales, you are probably way off base.

Step 6 – Go vs. No Go Decision

Once you complete your projections it is time for a go or no go decision. A booth rent model is certainly less risky if you can find a handful of stylists to rent a booth at your facility, you are in business. You don’t have to worry about bringing in enough clients to keep stylists busy, you don’t have to worry about

Financial Projections for E-2 Visa Applications

The E-2 Treaty Investor Visa is a nonimmigrant classification that presents a way for business owners or entrepreneurs to live in the United States and conduct business. It initially provides a two-year stay but the recipient can make repeated requests of 2-year extensions. The visa is growing at a fast rate, largely due to its level of acceptance compared to other types of visas.

| E-2 Visas | Issued | Refused | Total Applicants | Percentage Increase in Applicants |

| 2013 | 35,272 | 8,178 | 43,450 | N/A |

| 2014 | 36,825 | 9,782 | 46,607 | 7.27% |

| 2015 | 41,162 | 10,970 | 52,132 | 11.85% |

| 2016 | 44,243 | 13,370 | 57,613 | 10.51% |

A major benefit includes the fact that treaty investors may be accompanied by spouses and unmarried children who are under 21 years of age. The spouse is also able to work in the U.S. with this visa. This site lists out many of the details that are part of the process.

In analyzing E-2 Treaty applications, the government is looking for some specific qualifications for the business and investor. The qualifications for the applicant include:

- Be a national of a country with which the United States maintains a treaty of commerce and navigation

- Have invested, or be actively in the process of investing, a substantial amount of capital in a bona fide enterprise in the United States

- Be seeking to enter the United States solely to develop and direct the investment enterprise

Business Plan- Financials

A key part of the application process is creating a substantial business plan for the enterprise. The plan can be as long as 35 pages long, so it is worthwhile for an applicant to seek professional help in creating it. The plan includes five year financial projections, which can be a challenging portion to create. Often the government looks for:

- Break-even analysis

- Income statements

- Balance sheets

- Cash flow statements

- Financial assumptions

- Industry comparisons

Here at ProjectionHub, we have experience in creating proforma financial projections for customers. Visit our services page to fill out a short form to start the process of obtaining financials for your business!

Qualifications

Let’s break the qualifications for an E-2 Visa down.

- Be a national of a country with which the United States maintains a treaty of commerce and navigation

This means that the country in which the applicant is a citizen of must be a “treaty country” or a country with which the United States maintains a treaty of commerce and navigation. This site is a list of countries that qualify: https://travel.state.gov/content/visas/en/fees/treaty.html. The following chart breaks down the 2016 E-2 Visa Issuances by region:

| 2016 E-2 Visa Issuances by Location | |

| Africa | 160 |

| Asia | 17,364 |

| Europe | 18,469 |

| North America | 5,752 |

| Oceania | 415 |

| South America | 2,081 |

| No Nationality | 2 |

- Have invested, or be actively in the process of investing, a substantial amount of capital in a bona fide enterprise in the United States

The investor must hold a significant stake in the business in his or her application. The low-end of investments typically range from $100,000 to $150,000, so the more money invested, the more likely the application will be accepted. Another important consideration to note is that the capital must be subject to partial or total loss if the investment fails, signifying that the investor really did have a stake in the business. As long as the business is operating, the E-2 Treaty recipient can retain his or her status in the the United States. The USCIS (United States Citizens and Immigration Services) typically only accepts applicants who have already made the investment and are “irrevocably” committed to the business before application.” The capital must be invested in a business, not simply in a bank account in the U.S. Some evidence of a business being “bona fide” includes:

- Notice of assignment of an Employer Identification Number from the Internal Revenue Service (IRS)

- Tax returns

- Financial statements

- Quarterly wage reports or payroll summaries (i.e., W-2s and W-3)

- Business organizational chart

- Business licenses

- Bank statements, utility bills, and advertisements/telephone directory listings

- Contracts or customer/vendor agreements

- Escrow documents

- Lease agreement

http://www.immi-usa.com/e2-visa-requirements-for-investors/

- Be seeking to enter the United States solely to develop and direct the investment enterprise

This refers to the fact that the investor is an invaluable part of the business, either by ownership, executive management position, or possesses qualifications that are integral to the business. These qualifications include: the degree of proven expertise in the employee’s area of operations, whether others possess the employee’s specific skills, the salary that the special qualifications can command, and whether the skills and qualifications are readily available in the United States. The USCIS looks to accept businesses that will impact the economy and are not just “marginal” businesses. This means they add jobs and are sustainable.

If you have interest or want to learn more about how ProjectionHub can help you create a business plan for your E-2 Investment Visa, email adam@projectionhub.com. You can also fill out a form to contact us at https://projectionhub.com/services to start the process!

How Do I Use Formulas to Project Expenses or Revenue?

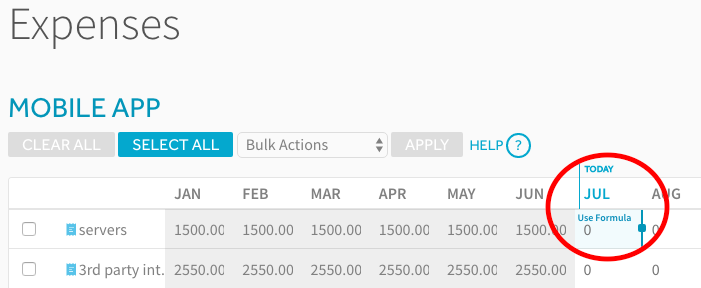

On ProjectionHub’s web application, you can use formulas to help fill in data for your sheet. This is a handy feature to use when you want to see how growing expenses will affect your financials!

If you know what your numbers will be for your starting month, hover over a cell and click “Use Formula.”

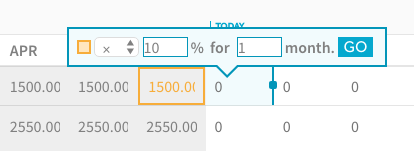

Next, choose what percentage you want the number to increase or decrease by and choose the number of months. You can also choose to add an amount for the chosen number of months.

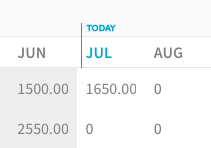

Click go to apply the formula.

You can use this feature on the Revenue page to project revenue in future months as well!

Get started making your financial projections by visiting projectionhub.com today!