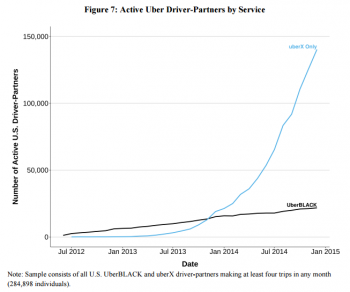

The number of Uber drivers is growing exponentially as seen in the hockey stick graph published by Forbes. So if you are considering becoming an Uber Driver, you should run some numbers first just to ensure that you understand what you are getting yourself into.

The number of Uber drivers is growing exponentially as seen in the hockey stick graph published by Forbes. So if you are considering becoming an Uber Driver, you should run some numbers first just to ensure that you understand what you are getting yourself into.

So to help you do this, we have created a couple of financial projection models for Uber Drivers:

- Uber Driver that Leases a Car

- Uber Driver that Owns a Car

Although according to a report released by Uber, 62% of drivers lease their car from Uber, it is likely that the most common reason a driver might need financial projections is when they are applying for a car loan to purchase a car to drive for Uber. That being said I am going to show an example financial projection assuming that you own a car or got a loan to purchase your own car.

Step 1 – Choose the “Uber Driver (Own Car)” Option when signing up here.

Step 2 – Add your business information

Step 3 – Add your projected sales – According to a report issued by Uber the average Uber driver in the US could earn $19 per hour. Obviously this will fluctuate significantly by city and by country, so you will need to try to determine what your hourly rate will be in your city. You might start by asking some other Uber drivers what they earn per hour. In this revenue section of ProjectionHub you will want to enter your total sales for the month before any expenses like gas, or car maintenance. So for this example I am going to assume you are driving full time, 40 hours per week, and earning $19 per hour. So let’s say you work 50 weeks per year x 40 hours x $19 per hour = $38,000. That means you earn $3,167 per month before expenses. In the example I assumed $3,167 as your monthly revenue.

Step 4 – Add projected expenses – Here you will need to add all of your expenses related to driving a car for Uber. This article provides 16 of the most common expenses for Uber drivers. I have taken this list and added these expenses to the Uber financial model in ProjectionHub. Some of the expenses are obvious, you should be able to add on your own, but some of them will take some estimations and calculations. I have included my assumptions and calculations for several expenses below:

How many miles will you drive per year? Before we can even calculate some of the costs you need to estimate how many miles you will be driving per year. According to an Uber Driver from San Francisco, he drives 50,000 miles per year and works 40 to 45 hours per week. Since we said you only work 40 hours per week in this example, let’s assume that you drive 45,000 miles per year. This will help us calculate other expenses.

Fuel – Now let’s assume you have a fuel efficient vehicle that gets 30 miles per gallon and let’s assume gas is $3 per gallon in your city. That means you should budget 45,000 miles / 30 miles per gallon x $3 per gallon = $4,500 per year or $375 per month.

Car Washes – Let’s assume 1 car wash every other week at $10 per wash which amounts to about $20 per month.

Insurance – Car insurance for an Uber driver is likely a bit higher than for a typical driver. MetroMile offers insurance for Uber drivers specifically and they charge $40 per month and 5 cents per mile. So that is an extra $188 per month in addition to the $40 per month for a total insurance cost of $228 per month.

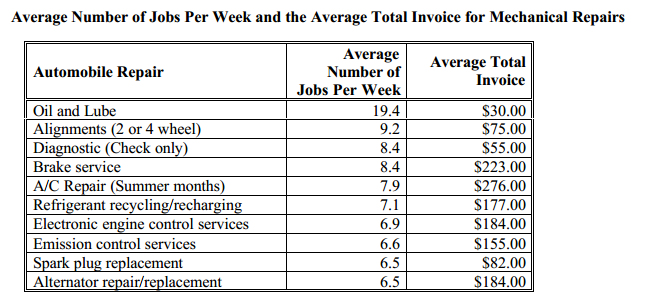

Vehicle Maintenance – According to Triple A the average maintenance cost of a vehicle per mile is right around 5 cents per mile. That is $188 per month in this example.

Then of course you will have other general expenses like license and registration, phone, tolls and parking fees, food and drink for passengers etc.

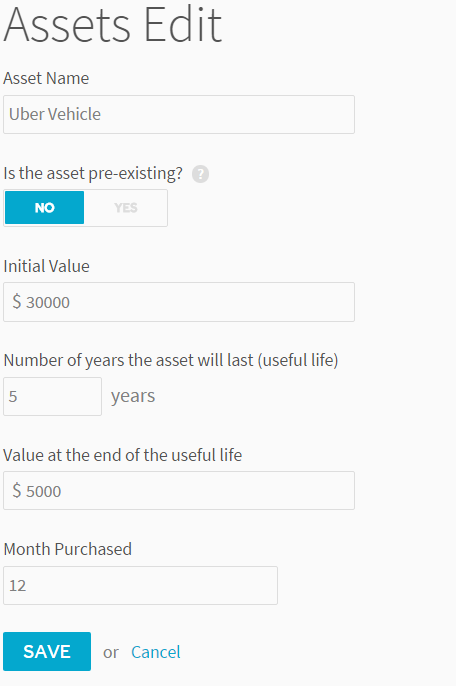

Step 5 – Add Assets – Here is where you need to add your car. In this example I am assuming that you own the car, or you got a loan to purchase the car. I have added a $30,000 car that will depreciate to $5,000 over 5 years. The depreciation expense will be added automatically to your expenses.

Step 6 – Add your Car Loan – Next you will need to add a loan (if you have one) for the car. In this example I added a $27,000 loan (assuming you put 10% down or $3,000 on the $30,000 car). In this example I added a new Liability/Loan for $27,000 at 7.5% for 48 months. Your payments are added automatically to your projections.

The purpose of this post is simply to walk you through the process of creating some projections for your Uber business. Good luck!

ProjectionHub – An app to create and share realistic financial projections with investors, lenders and partners without the pain of Excel.

ProjectionHub – An app to create and share realistic financial projections with investors, lenders and partners without the pain of Excel.